The Cost-Benefit Analysis of Comprehensive Risk Assessments

In today’s corporate environment, comprehensive risk assessments play a crucial role in ensuring sustainable business practices. These assessments help organizations identify potential risks that could threaten operational efficacy. A well-conducted risk analysis also assists in determining the appropriate mitigation strategies for such risks. However, the key question lies in whether the costs associated with these assessments justify the benefits they yield. Companies often grapple with the implications of investing in thorough risk assessment methodologies. By evaluating both the financial and non-financial implications of comprehensive analyses, firms can make informed decisions that align with their long-term strategic goals. Numerous methodologies exist that can be effectively utilized to evaluate potential risks. These methods include qualitative analyses, quantitative risk assessments, and semi-quantitative approaches. Each offers unique insights into organizational vulnerabilities and risk exposure. Ultimately, organizations must balance their appetite for risk against their ability to mitigate those risks while minimizing costs. Comprehensive risk assessments can significantly influence decision-making processes that drive efficiency and performance in the organization.

Understanding the benefit of conducting exhaustive risk assessments is critical for businesses aiming for sustainability and growth. These assessments allow organizations to evaluate the likelihood of adverse events and their potential impact. By identifying high-risk areas, firms can proactively manage vulnerabilities that may otherwise go unnoticed. The cost incurred during risk assessment processes should be cautiously evaluated against potential losses that can result from unaddressed risks. This financial analysis typically involves direct costs and opportunity costs associated with implementing risk management strategies. Additionally, the reputational costs can be significant when an organization experiences a security breach or public relations incident due to poor risk management. Conducting a thorough cost-benefit analysis that includes these variables provides a clearer understanding of the overall value derived from risk assessments. Organizations that spend time and resources improving their risk management processes often enjoy increased stakeholder confidence. This increased confidence can translate into measurable financial benefits over time, affirming the commitment to strong governance practices. When stakeholders view an organization as proactive in managing risks, they are more likely to invest and engage positively.

Critical Insights on Risk Management Practices

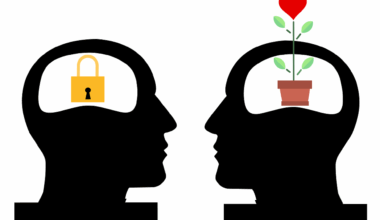

The incorporation of risk assessment methodologies into corporate governance frameworks is increasingly essential in the current business landscape. Organizations need to systematically approach risk management to ensure resilience against unforeseen challenges. Comprehensive risk assessments encompass various elements including financial, operational, strategic, and compliance risks. By employing diverse risk assessment techniques, organizations can develop a holistic view of their vulnerabilities and strengths. This understanding enables the formulation of robust policies that not only address current risks but also anticipate future threats. Moreover, risk assessments support effective resource allocation by directing attention and investment towards high-risk areas that demand immediate action. Businesses equipped with proactive mitigation strategies are likely to perform better during crises. The long-term benefits of robust risk management practices often significantly outweigh initial investment costs. Furthermore, organizations should systematically communicate the insights gained from risk assessments throughout their operational levels. This communication fosters a culture of awareness and accountability regarding risk management. Empowering all employees to recognize and address potential risks can enhance overall organizational resilience.

In implementing comprehensive risk assessments, organizations may consider leveraging advanced technologies such as data analytics and machine learning. These tools can streamline the risk identification process and yield insights faster than traditional methodologies. By utilizing these technologies, companies can harness vast amounts of data to illustrate potential threats and trends. Consequently, they can make well-informed decisions regarding which risks warrant more immediate attention. Additionally, automated risk assessment tools can mitigate human error, resulting in more accurate evaluations. Swift identification of potential risks means that organizations can proactively develop strategic plans to counteract them. Nevertheless, the adoption of technology carries its costs, including required training and potential system maintenance. Balancing these factors against the benefits yielded by comprehensive risk assessments is crucial. It showcases the need for continual evaluation of both methodologies and technologies used within risk management frameworks. The dynamic nature of risk necessitates adaptable processes that can be adjusted in response to new data. By fostering innovation in their risk management approach, organizations can remain relevant and thrive amid uncertainty.

Balancing Costs and Benefits in Risk Assessments

One of the defining characteristics of corporate governance is its focus on risk management. To mitigate risks effectively, organizations must balance costs incurred against the benefits obtained from comprehensive risk assessments. The challenge lies in adequately quantifying these elements. Cost categories encompass direct costs, such as consultancy fees and technology investments, alongside indirect costs like decreased productivity and employee engagement. While assessing benefits, it becomes essential to include tangible results and intangible advantages like improved reputation. Stakeholder trust can lead to increased investment and market presence, which are critical for long-term success. Therefore, it is vital to approach the assessment process with a comprehensive framework that aligns with organizational goals. Essentially, the value derived from effective risk mitigation strategies can be substantial, safeguarding both the organization and its stakeholders from potential threats. Employing a systematic methodology when analyzing risk assessments enables organizations to thoroughly understand this dynamic relationship between costs and benefits. Such an understanding will ultimately inform more strategic decisions in corporate governance, enhancing resilience and operational efficiency.

It’s essential to foster a strong risk-aware culture across all levels of the organization to fully realize the benefits of comprehensive risk assessments. Employee training efforts can significantly enhance the effectiveness of such assessments by ensuring that everyone understands their role in identifying and managing risks. When employees are equipped with the knowledge and tools to recognize potential risks actively, it promotes shared responsibility and accountability. Engaging staff in risk discussions also encourages open communication about concerns they may encounter in their roles. This cultural shift can empower employees to address challenges proactively, ultimately contributing to lower risk exposure and enhanced organizational performance. Organizations that foster such a culture tend to experience improved morale and collaboration among teams, leading to more effective problem-solving. Moreover, actively involving employees in risk assessments provides unique insights from diverse perspectives, which further enriches the overall assessment process. Incorporating feedback and insights from various teams forms a comprehensive understanding of potential vulnerabilities and enhances overall operational strategies. This collaborative approach not only strengthens risk management initiatives but also promotes stakeholder confidence in the organization.

Conclusion on Effective Risk Assessment

In conclusion, the cost-benefit analysis of comprehensive risk assessments is undeniably pivotal in the realm of corporate governance. By systematically evaluating both costs and benefits, organizations can develop informed strategies that bolster overall risk management efforts. The mathematics surrounding risk assessment is not merely numeric, but also encompasses stakeholder perceptions and market positioning. Deploying robust risk management practices strengthens organizational resilience, ensuring firms can navigate adversity effectively. As risk environments evolve, businesses must commit to continuous improvement of their assessment methodologies. Embracing technology while fostering a culture of risk awareness ultimately forms a crucial foundation for sustainable organizational success. Organizations that prioritize thorough risk assessments will reap the rewards of increased stakeholder trust, financial gains, and operational efficiency. It is paramount for executives to recognize the value that comprehensive risk assessments provide in informing strategic decisions. The integration of risk management into corporate culture also catalyzes positive organizational change and enhances governance standards. Thus, investing time and resources into risk management improvements is essential for long-term viability and significance within any industry.