Credit Risk Scoring Models: An Overview

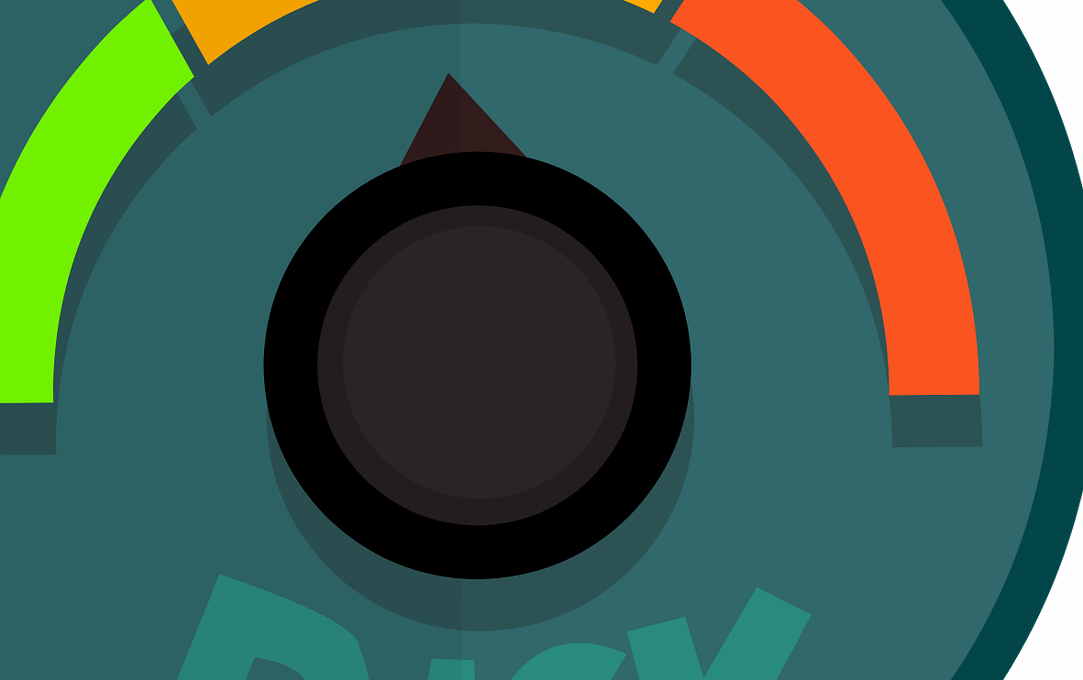

Credit risk scoring models serve as essential tools in the evaluation of a borrower’s creditworthiness. These models assist financial institutions in making informed lending decisions. They typically analyze historical data from various sources, including credit reports, payment histories, and economic indicators. By employing statistical techniques, lenders can assess the likelihood of default, allowing them to manage risks effectively. Scoring models generally categorize borrowers into different risk levels. Notably, high-risk borrowers may confront higher interest rates or denials. Different credit scoring methodologies are available, such as logistic regression and machine learning algorithms, which are increasingly being adopted in today’s financial landscape. Implementing a robust scoring model can significantly reduce financial losses by predicting default probabilities. Moreover, these models help lenders in regulatory compliance. Appropriate risk classification and management play pivotal roles in maintaining financial stability. It is therefore crucial for financial institutions to continuously evaluate and refine these scoring models to adapt to changing market conditions and consumer behavior. In conclusion, effective credit risk scoring models form the backbone of sound lending practices.

To develop effective credit risk scoring models, financial organizations typically gather a wealth of data, including customer demographics, credit history, and transactional behavior. Data preparation is a vital step in this process. This includes cleaning the dataset, handling missing values, and ensuring relevant features are included for analysis. The selection of variables can influence the model’s accuracy, so careful consideration is essential. Commonly used variables include sample credit utilization rates, past payment behavior, and outstanding loan amounts. After data preparation, various statistical methods are applied to create the scoring model. This phase involves segmentation and calibration processes, enhancing predictive power. A well-structured scoring model provides granular insights into potential risks associated with lending. Following model development, rigorous testing is essential to ensure its robustness and reliability. Lenders often perform backtesting, validating whether the model accurately predicts defaults based on historical data. When these steps are executed meticulously, financial institutions can significantly enhance their credit assessment processes. Monitoring and maintaining model performance over time allows for adjustments based on economic changes, thereby continually improving lending practices.

The validation of credit risk scoring models comprises a crucial aspect of their development and maintenance. Validation efforts ensure that the model performs accurately and effectively in a real-world setting. Techniques such as cross-validation can be employed to mitigate any biases during model training and evaluation. Financial institutions should also consider various metrics when assessing model performance, such as accuracy, precision, and recall, to understand its predictive capabilities. Additionally, proper documentation of the model’s results aids stakeholders in identifying its strengths and weaknesses. Regulators often scrutinize these models, requiring compliance with prevailing guidelines and standards. After validation, the model must be implemented into the organization’s risk management framework effectively. Training staff and understanding the application of these models across various departments is vital. Moreover, ongoing monitoring enables institutions to adjust scoring models as necessary based on data shifts and emerging trends. Through this validation and adjustment process, lenders can ensure that their scoring models remain relevant and reliable in predicting credit risk. In doing so, they can minimize potential losses while offering competitive lending products.

Model Types and Their Applications

Several types of credit risk scoring models are prevalent in the financial industry, catering to different types of lenders and borrowers. Traditional scoring models like FICO, for instance, assess a borrower’s creditworthiness based on historical credit behavior. On the other hand, alternative scoring models leverage unconventional data sources such as utility payments and rental histories to score credit. These approaches are particularly beneficial for underbanked consumers who may lack extensive credit histories. Moreover, machine learning-powered scoring models are gaining traction due to their ability to analyze vast datasets more efficiently. They uncover patterns that may not be evident through traditional methods, thus providing a more comprehensive risk assessment. Depending on the organization’s goals, they might choose to adopt one or multiple types of credit scoring systems. Ultimately, the choice of model affects the lending decisions, risk management, and overall customer experience. Understanding the strengths and limitations of each scoring type empowers lenders to improve their credit strategies and respond efficiently to market changes.

Besides the technical aspects, the ethical considerations of credit risk scoring models cannot be overlooked. Model bias can result in unfair treatment of certain groups, thereby exacerbating existing socioeconomic disparities. Therefore, lenders must take proactive measures to ensure fairness and transparency within their scoring systems. Incorporating fairness metrics during model evaluation can aid in identifying and mitigating bias. Model governance frameworks should be established to guide best practices for ethical model development and implementation. Some organizations even create advisory panels to assess the social impact of their credit scoring models. Engaging with community stakeholders can create insights into how these models affect different populations. Adopting more inclusive practices can significantly enhance consumer trust and acceptance. Additionally, focusing on explainability in credit scoring can help borrowers understand their scores better. Transparency surrounding how scores are calculated empowers borrowers to take actionable steps to improve their credit profiles. Ethical considerations should become integral parts of risk management strategies to promote fair and responsible lending.

As technology advances, the future of credit risk scoring models appears promising yet challenging. Innovations such as big data analytics, artificial intelligence, and blockchain technology continue to reshape how lenders approach credit risk assessment. Machine learning algorithms are increasingly capable of developing adaptive models that learn from new patterns and changing customer behaviors. Financial institutions adopting these technologies often reap significant competitive advantages. However, this rapid change necessitates the continuous updating of regulatory frameworks to ensure responsible usage. For instance, the integration of biometric data into credit assessments introduces both exciting possibilities and potential ethical dilemmas. As these models evolve, ensuring compliance with regulations will remain paramount. Additionally, measuring the effectiveness of these advanced models requires new evaluation methodologies. Lenders must be prepared to invest in training for their teams to leverage these evolving tools effectively. Moreover, upcoming market shifts and macroeconomic factors will necessitate constant monitoring of credit risk models. By fostering a culture of innovation and adaptability, financial institutions can harness the full potential of next-generation credit scoring models.

Conclusion and Future Perspectives

In conclusion, credit risk scoring models are indispensable to the financial industry, serving as tools for assessing borrowers and managing risks. The development and validation process, complemented by ethical consideration, augment model reliability and effectiveness. As technological advancements continue to emerge, organizations must remain vigilant in adapting their models to leverage new tools and methodologies. Engaging with the community, ensuring transparency, and maintaining fairness are integral to building consumer trust. Looking ahead, financial institutions that emphasize innovation and accountability in their credit risk assessment strategies will likely outperform their peers. Fostering a proactive culture will also ensure that the institutions can navigate the complexities of an ever-evolving credit landscape. The ability to assess risk accurately while presenting fair lending options is vital in contributing to an inclusive financial system. As credit risk models evolve, embracing change alongside ethical practices will reflect positively on lenders, enhancing their reputation and stability in the market.

In summary, the role of credit risk scoring models is crucial in maintaining a balanced financial ecosystem. These models not only help lenders minimize risks but also empower borrowers by providing insights into their creditworthiness. Through careful development, validation, and ethical considerations, credit scoring systems can adapt to changing economic climates and consumer behaviors. Ongoing monitoring and adjustments are essential to achieving long-term success in credit risk management. By prioritizing fairness and transparency, financial institutions can build trust with consumers while maintaining their competitiveness in the market. As regulatory scrutiny continues, proactive engagement with stakeholders will enhance these institutions’ understanding of diverse borrower perspectives. Future advancements will also necessitate continuous education for professionals in the credit risk domain, ensuring they remain up to date with the latest tools and techniques. In closing, the evolution of credit risk scoring models will undoubtedly shape the lending landscape for years to come, fostering a more inclusive and balanced approach to credit management.