The Importance of Intellectual Property in Seed Funding

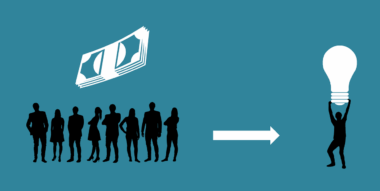

Seed funding is essential for startups, and intellectual property (IP) plays a vital role in securing this type of financing. Investors are often more willing to fund businesses that have clearly defined IP assets, as they provide a competitive advantage and potential for profit. Startups that protect their innovations can showcase their value to potential investors. Some of the main IP forms relevant to seed funding include patents, trademarks, and copyrights. Each of these assets can illustrate to investors that the company has a unique proposition that’s worth investing in. For instance, a patent can prevent competitors from entering the market, while a strong trademark builds brand recognition. Additionally, a well-maintained portfolio of IP can significantly enhance the valuation during funding rounds. By prioritizing the development and protection of IP, entrepreneurs can create a solid foundation for their businesses. Moreover, a solid IP strategy can help startup founders avoid costly legal disputes that might deter investors. The link between IP value and funding is crucial; therefore, focusing on this relationship is necessary for any successful funding endeavor.

Understanding Different Types of Intellectual Property

To successfully navigate the landscape of seed funding, entrepreneurs should understand the various types of intellectual property. First, patents protect inventions and processes that are novel, non-obvious, and useful. This protection allows startups to secure their unique technologies. Second, trademarks safeguard brand names, logos, and slogans. They help establish a company’s identity and command customer loyalty. By registering their trademarks, startups can prevent others from using similar branding. Finally, copyrights protect original works of authorship, such as software, music, and graphic design. Understanding these distinctions will help entrepreneurs leverage their IP effectively in discussions with investors. By ensuring their creations are protected, startups signal to potential financiers that they have taken the necessary steps to safeguard their innovations. Furthermore, potential investors prefer dealing with firms that have their IP well-structured as it minimizes risks associated with competition. Therefore, entrepreneurs must actively promote their IP positioning in pitch presentations. A well-defined IP strategy can also lead to better negotiations and terms during funding discussions in today’s competitive market.

Startup founders can greatly benefit from consulting with IP experts when it comes to seed funding. These professionals can provide valuable insights about the types of IP that are most relevant to the startup’s business model. In some cases, experts may recommend applying for provisional patents or conducting trademark searches before engaging with investors. This proactive approach can bolster the startup’s credibility. Moreover, any professional feedback received during this process can be used to enhance pitch decks and investor meetings, making a compelling case for funding. The expertise of IP consultants can also help startups avoid common pitfalls that may arise from improperly secured intellectual property. Regular audits of IP assets can ensure compliance and alignment with business goals. Furthermore, building relationships with IP attorneys can assist entrepreneurs in navigating the complexities of IP law. Engaging with these professionals not only provides clarity but also instills confidence in investors during seed funding rounds. When a startup shows diligence in protecting its intellectual property, it reflects a commitment to sustainable growth and profitability.

The Role of IP in Attracting Investors

Intellectual property is a powerful tool for attracting seed funding. Investors often look for startups that have a unique selling proposition and IP in place presents that uniqueness. By showcasing robust IP, startups can create differentiation in the marketplace, thereby enhancing their attractiveness to potential investors. The presence of patents or trademarks can also signal to investors that the startup possesses something distinctive that cannot be easily replicated. This can create a first-mover advantage, allowing startups to capture market share ahead of competitors. Furthermore, investors view IP as part of the overall valuation of a company; thus, startups with strong IP portfolios are often valued higher. Investors also appreciate the ongoing revenue potential from licensing agreements that can arise from a well-managed IP. As a result, startups that demonstrate a focus on developing and protecting their IP are more likely to secure the funding they need. A successful investment involves not only financial backing but also confidence in a startup’s long-term strategy, which IP can significantly contribute to.

Another crucial aspect of intellectual property and seed funding lies in its role in exit strategies. Investors typically aim for a return on their investment, and a solid IP portfolio can facilitate various exit opportunities, such as acquisitions or public offerings. If a startup possesses valuable intellectual property, larger companies may consider acquiring them to bolster their market position. This symbiotic relationship promotes a favorable environment for seed funding. Moreover, clear IP rights can simplify valuation processes during negotiations since investors will have better insight into the startup’s potential. A well-defined exit strategy that incorporates the monetization of IP assets can entice investors looking to maximize returns. Startups should clearly communicate how they plan to leverage their IP as part of their exit planning in presentations. By doing so, they demonstrate foresight and a strategic approach that can resonate positively with potential investors. The integration of IP within the broader business plan not only supports funding efforts but can also ensure a more sustainable growth trajectory post-funding.

Evaluating IP Risks Before Seeking Funding

Prior to seeking seed funding, startup founders must evaluate the risks associated with their intellectual property. Risks may stem from potential infringement claims by larger companies or inadequate IP protection strategies. Conducting thorough due diligence on existing patents and trademarks within the industry can mitigate such risks. Moreover, developing a comprehensive IP strategy is crucial in protecting innovations. Startups should be prepared to discuss their risk management plans with potential investors to build trust and credibility. Failure to identify and resolve IP risks before funding may deter investors altogether. Additionally, a history of unresolved IP disputes could significantly complicate future funding endeavors. Investors want assurance that there are no pending legal threats that could impact the startup’s operations. Therefore, proactive measures such as obtaining legal opinions, conducting clearance searches, and reviewing contracts related to IP rights can be beneficial. Establishing a solid foundation of risk assessment shows potential investors that the startup is serious about managing its intellectual property effectively and responsibly.

In conclusion, intellectual property is critically important for startups seeking seed funding. A strong IP presence can help secure financing, attract investors, and facilitate growth. By understanding the different types of IP available, engaging with professionals for guidance, emphasizing IP value during pitches, evaluating risks, and planning exit strategies, startups can strengthen their case to investors. Ensuring compliance with IP laws and best practices can also lead to better negotiation terms during funding discussions. Moreover, a clearly articulated IP strategy reassures investors of the startup’s future profitability potential. Overall, the role of intellectual property in seed funding cannot be overstated; it is an essential component of any successful funding strategy. Startups should begin prioritizing their intellectual property from day one and continually refine strategies as the business evolves. With the right focus on IP, businesses can improve their chances of attracting seed funding and achieving long-term success. A well-managed IP portfolio is not only an asset for the company’s value but also for its sustainability and growth in an increasingly competitive landscape.

Conclusion: The Path Forward

Entrepreneurs must focus on their intellectual property as they seek seed funding. Prioritizing IP protection and strategy encourages investor confidence and enhances the business’s valuation. Building a robust IP portfolio while continuing to innovate is vital for sustainable growth. Startups equipped with a clear IP plan for future funding rounds have a significant advantage over those who do not. This not only attracts potential investors but also fosters partnerships and alliances necessary for business success. By viewing IP as a strategic asset, startups can leverage their innovations to create unique market offerings. Staying ahead of industry trends and adapting to new technologies further enhances the startup’s IP landscape. Fostering an environment where creativity and protection coexist encourages continuous growth and adaptation. Thus, aspiring entrepreneurs should invest in their IP right from inception and ensure that it remains a part of their narrative. Through this lens, the importance of intellectual property in seed funding becomes evident, fostering a comprehensive approach to business growth while mitigating risks associated with financing.