Risk Communication: Engaging Stakeholders Effectively

Effective risk communication is essential in corporate finance to ensure that stakeholders are well-informed about potential uncertainties and their implications. Stakeholders include investors, employees, regulators, and the public, all of whom may be affected by risks associated with financial decisions. To engage these stakeholders effectively, organizations must adopt a structured communication approach. This involves not only delivering information but also listening to feedback and addressing concerns. Transparency is a key element in building trust, as it fosters openness and demonstrates that the organization values stakeholder opinions. By initiating dialogues around risks, firms can better understand stakeholder perspectives and ultimately align their strategies with stakeholder expectations. The complexity of risk management requires strategies that can address stakeholders’ diverse informational needs. Companies can utilize various communication channels, such as public announcements, social media, and stakeholder meetings, to relay their messages. These channels should be selected based on their effectiveness in reaching specific audiences. Here, understanding the audience’s preferences and the context of the risk being communicated will significantly influence the effectiveness of the communication strategy.

The Importance of Tailored Communication

Tailored communication is critical in risk management as different stakeholders have different levels of understanding and concern regarding financial risks. Customizing messages ensures that each group receives relevant information that addresses their specific interests and knowledge gaps. For example, while sophisticated investors prefer detailed technical information, regulators require assurance about compliance and risk mitigation strategies. Employees, on the other hand, may need clarity about the organization’s resilience and security measures in relation to identified risks. By recognizing these varying needs, organizations can craft messages that resonate more effectively with each group, enhancing engagement and comprehension. Additionally, utilizing storytelling techniques can make risk information more relatable. Storytelling can highlight real-world examples or potential scenarios that emphasize the consequences of risks. This method can captivate audiences and improve retention of critical information. Furthermore, it is essential to be proactive rather than reactive in communication. This proactive approach not only prepares stakeholders for potential risks but also showcases the organization’s commitment to risk management. Scheduling regular updates can keep stakeholders informed about developments and foster an ongoing relationship built on trust and accountability.

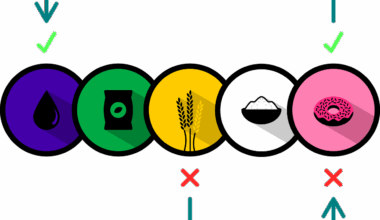

Utilizing Visual Communication Tools

Visual communication tools play an integral role in effectively conveying risk information to stakeholders. Charts, graphs, and infographics can transform complex data into understandable visuals, allowing stakeholders to grasp essential insights quickly. Visual aids not only simplify data interpretation but also capture the audience’s attention more effectively than text alone. By incorporating visuals, organizations can highlight trends, forecast potential impacts, and summarize key points succinctly. For instance, risk heat maps can visually represent the likelihood and consequences of various risks, aiding stakeholders in prioritizing risks based on severity. It is crucial to ensure that visuals are clear, concise, and relevant to the message. Additionally, organizations can use interactive dashboards to enable stakeholders to explore data dynamically and tailor information to their specific needs. This engagement through interactivity can deepen understanding and stimulate stakeholder interest. However, it is essential to complement visuals with clear explanations and context. Without adequate explanation, visuals may be misinterpreted. Therefore, combining visual tools with narrative descriptions ensures that stakeholders receive a comprehensive understanding of the risks presented. This synergy enhances the overall effectiveness of risk communication.

Measuring the effectiveness of risk communication is vital to ensure that stakeholders comprehend and respond appropriately to the messages conveyed. Organizations should establish metrics to evaluate how well their communication strategies are yielding the desired outcomes. Surveys, feedback forms, and follow-up interactions can provide valuable insights into stakeholder perceptions and understanding. These evaluations can help identify any gaps in knowledge or concerns that may have been overlooked. Furthermore, organizations should adopt a continuous improvement approach to risk communication. With feedback in hand, companies can adjust their strategies to better meet the needs of stakeholders, implementing regular evaluations to track evolving perceptions and responses. It is also essential to maintain an open line of communication, facilitating an environment where stakeholders feel comfortable expressing their questions or concerns. This openness encourages ongoing dialogues and reinforces stakeholder engagement in risk management processes. As stakeholders become increasingly involved, they may also become advocates for the organization, reinforcing trust and commitment. Ultimately, measuring communication effectiveness not only improves stakeholder relationships but also strengthens the organization’s overall risk management strategies, ensuring resilience in the face of uncertainty.

Engaging Stakeholders through Collaborative Approaches

Collaboration stands at the forefront of effective risk communication practices, allowing organizations to engage stakeholders more deeply. Establishing partnerships with stakeholders encourages a shared responsibility for managing risks and developing strategies to mitigate them. Participatory approaches help build a culture of inclusivity, where stakeholders feel that their voices are heard and valued. This sense of belonging can enhance commitment to organizational goals and risk management practices. Organizations can organize workshops, collaborative meetings, and roundtable discussions to facilitate open dialogues about risks. These forums allow stakeholders to share their views, experiences, and suggestions openly, ultimately enriching the risk management process. Moreover, utilizing collaborative tools such as shared platforms for communication can foster ongoing engagement and transparency, allowing stakeholders to track changes in risk assessments and strategies. By incorporating diverse perspectives, organizations can refine their understanding of potential vulnerabilities and enhance their risk mitigation plans. Collaborative engagement nurtures trust and loyalty, pivotal for sustaining long-term stakeholder relationships. As stakeholders become more engaged in the risk management process, they are more likely to act as allies, assisting organizations in navigating challenges and ensuring resilience.

Conclusion

In conclusion, effective risk communication is an essential aspect of corporate finance and risk management. By engaging stakeholders through tailored messages, visual aids, and collaborative approaches, organizations can ensure better understanding and support for their risk strategies. Transparency, clarity, and responsiveness are pivotal to fostering trust and active participation among stakeholders. Moreover, continuous improvement and evaluation of communication strategies will enable organizations to adapt to changing stakeholder needs, ultimately enhancing their risk management efforts. As organizations navigate an increasingly complex risk landscape, prioritizing effective communication will not only mitigate potential threats but also build resilient networks of stakeholders who are prepared to navigate uncertainties together. In such collaborative environments, organizations and stakeholders can harmonize their efforts toward sustained growth and success. Risk communication is not merely about delivering information; it is about fostering relationships and enhancing the collective capacity to manage risks. Therefore, organizations should embrace innovative communication strategies that resonate with their stakeholders, promoting a culture of proactive risk engagement for a sustainable future.

Ultimately, successful risk communication hinges on the ability to listen, adapt, and engage with stakeholders effectively. As organizations evolve, embracing new technologies and methodologies will become increasingly important in risk management. By integrating these approaches into their communication strategies, organizations can position themselves to face challenges head-on. Stakeholder engagement is an ongoing process that requires vigilance, adaptability, and a commitment to transparency. Therefore, organizations should prioritize developing a comprehensive communication framework that anticipates risk scenarios and prepares stakeholders adequately. The insights gleaned from stakeholders will be invaluable, providing a wealth of knowledge that can enhance risk management frameworks. As organizations continue to navigate the complexities of corporate finance and risk, an emphasis on effective communication will be a cornerstone of success. By fostering a culture of collaboration, organizations will not only safeguard their interests but also contribute positively to the broader financial ecosystem. In an era where information is paramount, investing in risk communication capabilities will emerge as a strategic advantage, ensuring informed and proactive stakeholders who can withstand the challenges of volatility. Engaging stakeholders effectively will ultimately lead to sustainable growth and robust organizational resilience.

In summary, organizations should embrace risk communication as a fundamental pillar of their corporate finance strategies. The importance of establishing clear and effective communication channels cannot be understated. Engaging stakeholders is not just about conveying information but building lasting relationships based on trust and mutual understanding. Continuous efforts in tailoring messages, utilizing visual tools, and adopting collaborative approaches will play a significant role in risk management success. Furthermore, organizations must remain flexible and responsive, continuously assessing the effectiveness of their communication efforts. Establishing metrics and feedback mechanisms can provide valuable insights for refining risk communication strategies. In this dynamic environment, active stakeholder engagement cultivates an informed community equipped to address risks collectively. Such proactive strategies can enhance overall organizational resilience and performance, ensuring the organization’s stability. As organizations continue to evolve, the ability to communicate risks effectively will distinguish successful companies. Ultimately, risk communication is not a mere act; it is an ongoing commitment to fostering engagement, understanding, and collaboration with stakeholders at every level. By prioritizing effective risk communication, organizations pave the way for a sustainable future built on collective resilience and shared success.