How Business Consulting Enhances Mergers and Acquisitions Outcomes

In the complex realm of mergers and acquisitions (M&A), business consulting plays a pivotal role in securing great outcomes. M&A transactions demand thorough analyses surrounding the financial health, cultural alignment, and operational efficiencies of businesses involved. A specialized consulting firm can provide invaluable insights, mitigating hidden risks and ensuring that both parties achieve their strategic objectives. Consultants bring together cross-functional teams with expertise in finance, legal issues, and industry knowledge. Their extensive experience facilitates seamless communication among key stakeholders. In addition, they help in designing tailor-made strategies that enhance negotiation processes and terms of the merger or acquisition. By emphasizing collaboration and transparency, business consultants assist in aligning goals from the outset. The use of analytical tools and market intelligence further supports informed decision-making. Moreover, effective business consulting can utilize assessment frameworks that advance organizational readiness and prepare for integration. Ultimately, the contributions from consultants can lead to smoother transitions and optimized growth post-transaction. Thus, they not only enhance the overall M&A outcome but also facilitate better value realization for shareholders in the longer term.

One significant advantage of engaging business consultants during M&A processes is their ability to perform detailed due diligence. This is essential for uncovering potential vulnerabilities in the companies involved which might otherwise remain hidden. Due diligence encompasses various aspects, including financial statements, legal obligations, and operational practices. Consultants can utilize their expertise to assess whether the valuations assigned to a company are justified and sustainable. This analysis ensures that acquiring firms do not overpay for target companies. Furthermore, insights gained during due diligence can shape negotiations and influence the final deal structure. By identifying synergies and potential cost savings, consultants provide crucial information that streamlines integration efforts. Another benefit is the consultants’ network of contacts, which can aid in sourcing alternative financing options or identifying strategic partners. Enhancement of negotiation strategies is achievable as consultants contribute meaningful data and industry benchmarks. This solid foundation of information ensures that stakeholders are empowered to make timely decisions. As a result, the risk exposure for both parties is reduced, culminating in a more successful outcome for the merger or acquisition.

Strategic Integration Planning

Post-transaction, the critical phase of integration begins, where business consulting continues to be invaluable. Effective integration planning is essential to realize synergies and achieve projected growth targets. Consultants aid in mapping out integration strategies that clarify roles and streamline operational procedures. Without proper guidance, integrations can lead to cultural clashes and operational turmoil. Thus, having consultants participate helps bridge gaps that exist between the merging companies’ cultures. This cultural alignment is often overlooked, yet it is essential for employee retention and morale. Strategic consultants facilitate workshops and team-building exercises to promote collaboration and understanding among staff. They help craft communication strategies that ensure clarity and foster a sense of unity during the integration journey. Additionally, consultants employ best practices in change management, which is critical when shifting organizational structures and priorities. Keeping stakeholders informed and engaged throughout the process lessens disruption. In this way, consultants can ensure that the merged entity moves cohesively toward common goals, driving both performance and operational efficiency, ultimately leading to enhanced shareholder value.

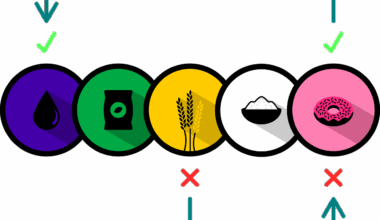

Risk management is another crucial facet of M&A consulting that requires attention. In any merger or acquisition, various risks can arise, including market volatility, regulatory changes, and potential customer attrition. Business consultants enable organizations to identify these risks early on, allowing appropriate mitigation strategies to be developed. They utilize risk assessment tools to evaluate potential impacts on financial performance and market positioning. Consultants’ extensive industry knowledge also aids in navigating compliance issues, particularly important in highly regulated sectors. By providing insights into emerging trends and regulatory developments, consultants keep firms on the front foot. Their focus on risk management ensures organizations are not only prepared for potential challenges but are also agile in their responses. Organizations equipped with a robust risk management strategy are better positioned to maintain operational continuity and secure customer loyalty during transitions. In turn, these proactive measures result in minimizing disruptions and optimizing outcomes of the merged entity. Thus, effective risk management through business consulting ultimately strengthens the viability of M&A transactions.

Enhancing Negotiation Strategies

Negotiation is a fundamental component of successful mergers and acquisitions, and business consultants play a vital role in enhancing these strategies. The negotiation phase often determines the terms and conditions essential for both parties’ satisfaction. Consultants possess the analytical skills and market knowledge necessary to identify negotiation levers that can maximize value for their clients. They prepare companies by conducting scenario analyses and role-play exercises that bolster confidence during critical discussions. Furthermore, consultants validate assumptions regarding market conditions and provide competitive positioning insights that inform negotiation tactics. By leveraging industry benchmarks, consultants assist their clients in understanding the parameters of what constitutes a fair deal. Their strategic input aligns negotiation goals with the overall vision of the acquisition, leading to better outcomes. Transparency is fostered in the negotiation process, allowing both parties to work toward mutually beneficial solutions. This collaboration helps to obviate potential disputes and fosters a positive atmosphere throughout the transaction. Ultimately, enhanced negotiation strategies not only save costs but reinforce strong relationships between merging entities.

Another essential role of business consulting in M&A is providing post-deal evaluation and assessment. This process is crucial for understanding the efficacy of the merger or acquisition. Post-deal assessments allow organizations to measure achieved outcomes against predefined expectations. Consultants engage in comprehensive analysis to determine whether strategic objectives have been met. Through performance metrics and stakeholder feedback, they provide insights into successes and areas needing improvement. This evaluation process enables firms to learn valuable lessons, creating a foundation for future M&A endeavors. Moreover, consultants can facilitate continuous engagement with teams to address immediate concerns and ensure that the operational integration is on track. Celebrating achievements and identifying obstacles early-on are key aspects of effective post-deal analysis. The knowledge gained not only enhances future planning but also helps solidify internal processes across the new organization. Additionally, business consulting reinforces accountability, ensuring that all parties remain committed to the post-merger integration efforts. Ultimately, thorough post-deal assessments contribute to long-term success and sustainability of M&A outcomes.

Conclusion: The Value of Business Consulting

In conclusion, the role of business consulting in mergers and acquisitions is indispensable. From due diligence through to post-deal evaluation, consultants drastically enhance the likelihood of favorable outcomes, ensuring that all parties are on aligned paths toward achieving their strategic goals. Their expertise in risk management, negotiation strategies, and integration planning provides organizations with a competitive edge in an intricate market landscape. The ability to harness data, engage stakeholders, and promote cultural alignment manifests in smoother transitions and optimized performance. Mergers and acquisitions are intricate processes laden with complexities, yet the contributions of consultants simplify these challenges. By fostering transparency, accountability, and collaboration, business consultants bolster success rates. Organizations that invest in consulting services are better equipped to navigate the ever-changing landscape of business environments. These proactive measures support achieving synergies and unlock value from acquired assets. Ultimately, business consulting partners are vital players that drive value creation in M&A transactions. Thus, recognizing their role can significantly impact the enduring success of any merger or acquisition journey.

Whether a business seeks to acquire or merge, an intentional focus on consultant engagement can drastically change the outcomes for stakeholders. By harnessing the expertise found in these services, organizations can address challenges with confidence, achieve strategic alignment, and realize sustained growth. Over time, the value of M&A consulting will continue to be a cornerstone of strategic business endeavors.