How to Conduct an Insurance Risk Assessment Effectively

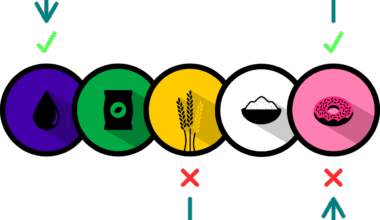

Understanding the intricacies of insurance risk management is vital for assessing and mitigating potential losses. A thorough risk assessment helps identify vulnerabilities that could lead to significant financial impacts. Each organization must approach risk management by evaluating external and internal factors influencing risk. External factors include regulatory changes, economic trends, and market volatility, while internal factors comprise company practices, operational efficiency, and employee training. It is necessary to gather data and insights comprehensively to form the foundation of a risk assessment strategy. This process can encompass conducting interviews with employees, reviewing existing documentation, and analyzing performance metrics. Once relevant information is compiled, it’s important to categorize risks according to their likelihood and potential impact. It allows risk managers to prioritize which risks need immediate attention while maintaining an overview of all potential threats. Establishing this risk landscape is crucial for informed decision-making and timely action. Identifying insurance coverage needed and developing action plans directly aligns with these assessments. Consequently, organizations can implement appropriate insurance solutions to manage their identified risks effectively.

Next, once risks are identified, organizations need to evaluate their existing policies and coverage. This task involves comparing current insurance practices against identified risks, ensuring that protection measures are adequate. If gaps are found, it may highlight the necessity of adjusting existing insurance policies or obtaining additional coverage. Multi-faceted approaches often yield the best results. Furthermore, integrating quantitative and qualitative analyses aids in understanding overall risk exposure. Using quantitative metrics helps organizations analyze potential financial losses due to different events. Contrast these with qualitative assessments to capture less measurable aspects, such as reputational impact or emotional distress. Insurance professionals play a vital role in this evaluation process, becoming valuable resources through their understanding of market offerings. As part of this assessment, organizations should also analyze historical data to identify patterns and learn from past experiences. This will help improve decision-making capabilities in the future. Creating an internal report summarizing findings and communicating these insights throughout the organization is essential. By ensuring alignment among stakeholders, organizations can cultivate a proactive risk management culture that extends beyond mere compliance.

Developing a Risk Management Framework

To fortify insurance risk management further, crafting a comprehensive risk management framework is vital. This structured approach lays out procedures for consistently identifying, assessing, and mitigating risks. A risk management framework typically includes establishing clear goals and objectives while engaging all stakeholders in its development. Communication channels should facilitate ongoing discussions about emerging risks and any changes in the operational landscape. Regular training sessions can significantly improve employees’ awareness of insurance risks, making them more equipped to identify them proactively. Additionally, integrating technologies such as risk assessment software can streamline data collection and analysis. Implementing a centralized database enhances accuracy and aids in informed decision-making. Regular reviews to ensure the framework’s effectiveness are also crucial. Organizations should schedule periodic assessments to evaluate the framework’s performance and make adjustments based on findings. This iterative process strengthens the organization’s resilience against risks and promotes adaptability amidst changing environments. Importantly, fostering a risk-aware culture can encourage continuous learning about risk management best practices. Employees empowered to participate in risk assessments can contribute invaluable insights, enhancing the overall assessment quality.

Once a risk management framework is developed, it’s crucial to implement regular monitoring and reporting mechanisms. These measures allow organizations to track the effectiveness of their risk mitigation strategies and adapt as needed. Regular audits of insurance policies ensure that coverage remains aligned with the evolving risk landscape. Additionally, it’s essential to leverage technology for real-time monitoring of risks. Risk management software can help in identifying anomalies and providing insights on emerging threats. This proactive stance will help organizations respond expediently to changes. An effective communication plan should be established to update stakeholders about significant changes or incidents related to risk. The emphasis should be on transparency to build trust among employees, stakeholders, and clients. Cultivating a feedback loop can also enhance communication efforts, inviting insights on risk strategy performance from various departments. Continuous improvement practices driven by collected feedback can refine the risk management framework over time. Organizations can further optimize their processes by analyzing the performance of risk management practices against established goals. Overall, ongoing evaluation is vital to stay ahead of potential threats and ensure adequate insurance coverage.

Employee Involvement and Training

Employee involvement is instrumental in the success of any insurance risk assessment. Those on the front lines are often the first to notice changes or deficiencies in operating procedures. Engaging employees in risk assessments can lead to valuable insights, enabling organizations to tailor their risk management strategies effectively. Training should form a core component of this engagement. Regular training sessions ensure that employees are well-versed in identifying risks and understanding their roles in the risk management process. Developing workshops or simulations can help reinforce knowledge about risk identification and reporting procedures. Furthermore, promoting a culture of shared responsibility encourages staff to actively participate and speak up about potential risks. Open channels for communication should be established, allowing employees to raise concerns about risks without hesitation. Recognition for proactive risk management behaviors can boost morale and foster an environment focused on continuous improvement. By merging employee insights with quantitative data, organizations strengthen their vulnerability assessments, enhancing overall risk management effectiveness. A collaborative approach not only identifies risks promptly but also empowers employees to take ownership in addressing them.

Lastly, continuous improvement is the backbone of effective insurance risk management. Organizations should establish systems for integrating lessons learned from past assessments into their ongoing practices. This includes regularly revisiting previous assessments and refining risk identification methods based on new information or trends. Maintaining an up-to-date repository of risk assessment activities ensures that all stakeholders are aware of the decisions made and strategies adopted. Additionally, staying informed about industry developments and emerging risks is essential for proactive risk management. Participating in insurance associations or attending workshops can enhance knowledge about best practices in risk management. Networking with industry peers can also provide insights into effective strategies for mitigating risks. Furthermore, organizations should make use of analytics to measure risk exposure continuously and evaluate the effectiveness of risk management initiatives. Through data-driven insights, organizations can identify areas needing attention and improvements. Overall, embracing a mindset of continuous improvement cultivates resilience amid uncertainties, fortifying an organization’s ability to navigate complex risk landscapes. Ultimately, this diligent approach to refining risk management strategies is invaluable in safeguarding both assets and reputation.