The Psychological Aspects of Risk Capital Decision Making

Risk capital decision-making is deeply influenced by psychological aspects. Cognitive biases play a significant role, as individuals often make irrational choices. Behavioral finance explains how emotions and mental shortcuts affect investment decisions. Investors may become overconfident, leading to underestimating risks. Alternatively, anxiety may paralyze decision-making, causing missed opportunities. Understanding these biases is crucial for better investment outcomes. Psychological factors can lead to groupthink in corporate settings. When teams conform to popular opinions, they may overlook critical data. A lack of diversity in thought can be detrimental. Stress and pressure also impact risk assessments. For instance, high-stakes environments may impair rational judgment. Decision fatigue is another concern—intense mental effort can reduce quality choices. Awareness of these psychological influences can help mitigate their effects. Training and development in emotional intelligence are recommended. Encouraging open discussions fosters diverse perspectives, improving group decision-making. Implementing structured frameworks for evaluations is beneficial. These frameworks minimize the influence of biases. Overall, understanding the psychological factors involved in risk capital management is imperative for sound financial decision-making.

Investors face many challenges when making risk capital decisions. Uncertainty is inherent in financial markets, heightening stress levels. Those who acknowledge their emotional responses typically make informed choices. Self-awareness enhances one’s ability to navigate complex situations effectively. Emotional resilience is essential in mitigating irrational behavior under pressure. It allows individuals to maintain perspective, crucial when weighing investment options. Risk tolerance varies among investors, influenced by personal experiences and emotional stability. Understanding one’s risk appetite assists in making sound financial commitments. Furthermore, research suggests that decision-making can become flawed under emotional duress. To counter this, individuals should establish clear investment criteria before entering high-stakes realms. A disciplined approach acts as a safeguard against impulsive choices. Additionally, collaboration with financial advisors can help temper emotional biases. Advisors provide objective insights, a crucial component in balanced investment assessments. Using data-driven methods minimizes the role of emotional reactions. The adoption of analytical tools enhances decision accuracy and confidence. Regularly reviewing and adjusting investment strategies according to changing market conditions is vital. Ensuring adaptability supports long-term success in risk capital management.

Understanding Cognitive Biases

The interplay between psychology and finance gives rise to various cognitive biases. Confirmation bias occurs when investors prioritize information that supports existing beliefs. This often results in poor financial decisions, as critical data may be ignored. Another significant bias is loss aversion, where the pain of losing is felt more intensely than the joy of winning. This leads to overly conservative strategies and an aversion to risk-taking. Anchoring is another phenomenon where initial information drastically affects subsequent judgments. If an investor fixates on a specific price point, it may skew their perception of a stock’s value. Moreover, overconfidence can result in excessive trading and poor risk assessments. Investors often overestimate their ability to predict market movements, leading to detrimental outcomes. Understanding these biases equips investors to recognize and mitigate them. Educating oneself about cognitive psychology can foster better investment strategies, enhancing decision-making skills. Techniques, such as journaling investment reviews, can help in identifying biases. Incorporating mindfulness practices may enhance emotional regulation, contributing to improved decision quality. Striving for continuous learning enables investors to adapt effectively to market changes.

In the realm of risk capital management, emotions are not merely distractions; they are influences. The emotional impact of financial decisions can skew perceptions and lead to drastic consequences. Neuroscience reveals how fear and greed drive investment behaviors, often in unpredictable manners. The prospect of earning a significant return can make individuals overlook risks. Conversely, experiencing market downturns may foster a chronic feeling of insecurity. Cultivating emotional intelligence is essential for navigating these tumultuous waters. It enables investors to recognize their emotional triggers and adapt accordingly. Furthermore, self-reflection on past decisions encourages growth and critical evaluation. Understanding trends in behavior can inform future strategies. Communication within investment teams is crucial for addressing emotional factors. Open discussions about feelings related to market conditions can create a supportive environment. Failure to address emotions can lead to poor team dynamics and decision-making. Institutions might benefit from instituting mental health awareness programs, promoting a holistic approach to investment. Tackling emotional aspects proactively aids in building resilience among investors. Such investments in emotional well-being can ultimately enhance performance and decision-making efficacy in risk capital management.

Group Dynamics and Decision Making

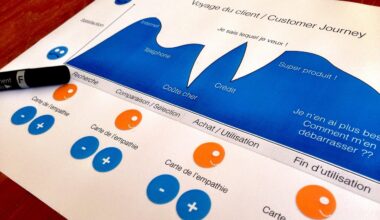

The dynamics of small groups greatly influence risk capital decisions. Teams often fall prey to social pressures that can cloud judgment and lead to suboptimal outcomes. Groupthink, characterized by a lack of critical thought, can stifle innovation and healthy debate. Diverse teams can counteract this pitfall by introducing multiple perspectives. Encouraging dissent in discussions allows for comprehensive evaluations of decisions. Leaders play a pivotal role in shaping group dynamics, fostering an environment where differing opinions are respected. Building a culture of psychological safety ensures that team members feel free to express concerns without fear of backlash. Tools for collaborative decision-making can also improve outcomes. Utilizing structured frameworks like SWOT analysis encourages a methodical approach to risk assessment. Furthermore, time allocations for discussion can enhance thorough consideration of potential investments. Ensuring adequate time for reflection prevents hasty conclusions driven by group pressure. Regular evaluations of group decisions, including post-mortem analyses, are beneficial. They provide insights into what worked and what could be improved. Ultimately, addressing group dynamics can enhance the quality of risk capital decision-making.

Risk capital management also necessitates an understanding of individual differences in behavior. Personal investment philosophies often stem from upbringing and professional experiences. Emotional maturity is a significant factor in how decisions are made. Those who can manage their emotions tend to make more rational choices. Individuals with high emotional intelligence usually seek out knowledge to equip themselves better. The ability to process market information critically is vital. Moreover, motivations for investment can vary widely among individuals, leading to different risk preferences. These motivations can be intrinsic, such as personal ambitions, or extrinsic, such as societal pressures. A tailored approach in education and communication can enhance understanding, allowing for better investment alignment. Financial literacy programs specifically designed to address psychological factors are beneficial. They equip investors with tools to identify personal biases and regulate emotional responses. Additionally, mentoring can provide a supportive framework for those navigating risk capital decisions. Insights from experienced investors can illuminate the path toward sound investment choices. Creating peer support networks further enriches understanding and decision-making quality. Emphasizing psychological elements offers a more nuanced understanding of risk capital management.

The implications of psychological aspects on risk capital decision-making are far-reaching. Organizations benefit significantly when they prioritize emotional and cognitive dynamics among investors. Enhancing awareness of biases and emotional triggers leads to improved financial decisions. By fostering a culture of continuous learning, companies can adapt more readily to market fluctuations. This adaptability is essential in the ever-evolving financial landscape. Moreover, integrating emotional intelligence training into professional development fosters resilience. Accounting for psychological factors forms the basis for superior investment strategies. Understanding the role of stress and emotion can guide investors toward more balanced choices. Encouraging self-awareness and collaboration among teams promotes healthier decision-making practices. Ultimately, awareness of psychological influences empowers decision-makers. Such empowerment informs risk assessments and encourages solutions to mitigate biases. The intersection of psychology and finance creates opportunities for meaningful changes. Companies that recognize these aspects stand to gain competitive advantages where others falter. The future of risk capital management lies in an in-depth understanding of human behavior. As we explore the psychological dimensions of decision-making, we build a foundation for financial success. Investing in emotional and psychological insights will yield dividends in organizational growth.