Foreign Direct Investment and Integration into Global Value Chains

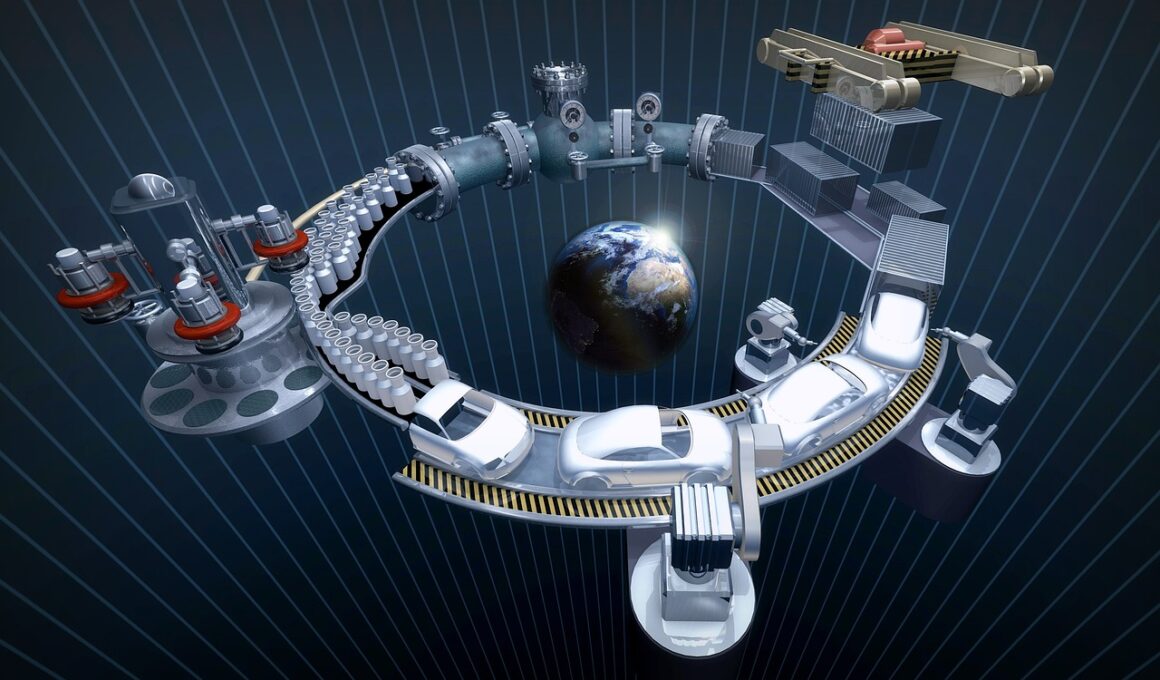

Foreign Direct Investment (FDI) refers to investments made by a company or individual in one country into business interests located in another country. These investments can take various forms, including establishing business operations or acquiring local companies. FDI is essential for facilitating capital transfer, technological advancements, and organizational knowledge between nations. A significant aspect of FDI is its role in enabling countries to integrate seamlessly into Global Value Chains (GVCs). GVCs represent the full range of activities involved in producing goods and services, all the way from raw materials to the final consumer product. By attracting FDI, countries can attract foreign companies that contribute to their economic development and growth. Companies engaging in FDI typically seek to diversify markets, access resources, or leverage local talent to enhance productivity. Moreover, integrating into GVCs allows participating countries to achieve economies of scale and improved competitiveness, as they can specialize in specific segments of production and contribute value to a broader supply chain. Overall, FDI and GVC integration create mutual benefits for both the investing and host countries.

The Importance of FDI in Economic Development

Foreign Direct Investment plays a crucial role in fostering economic development within host countries. It provides the necessary capital that fuels infrastructure development, job creation, and the transfer of advanced technologies and managerial expertise. Countries that successfully attract FDI often experience accelerated growth rates, contributing to improvements in productivity and GDP. FDI initiatives generally spur domestic investments, as local firms can gain access to new markets and adopt best practices from foreign companies. Furthermore, the creation of new industries and services leads to enhanced employment opportunities and skill development for local workforces. FDI also generates tax revenues for governments, which can be reinvested into public services such as education and healthcare. Additionally, through various spillover effects, local firms that collaborate with foreign investors often see increased competitiveness. They benefit from exposure to international standards, access to global markets, and collaboration opportunities. In summary, FDI serves as a catalyst for comprehensive economic growth, benefiting not only the host country but also enhancing global business interactions and market dynamics.

Multi-national companies often use Foreign Direct Investment as a method to strategically position themselves within Global Value Chains. Through FDI, these companies gain access to local resources and a skilled workforce, allowing them to optimize production costs. Often, firms establish production facilities in regions where labor is more affordable or where specific resources are abundant. This geographical diversification helps mitigate risks associated with market volatility and supply disruptions. However, to successfully integrate into GVCs, it is not enough for companies to invest in physical assets. They must also focus on building strong relationships with local suppliers and understanding the cultural nuances of the markets in which they operate. In many cases, successful firms tailor their products and services to meet local consumer preferences. This adaptability, fueled by FDI, not only strengthens market presence but also fosters innovation. As companies tap into diverse markets, they can leverage various insights to improve product offerings and service delivery. Consequently, FDI serves as an enabler of both international market penetration and cultural adaptation, enhancing competitiveness across borders.

Challenges of FDI in Global Value Chains

Despite its advantages, Foreign Direct Investment presents various challenges for companies attempting to integrate into Global Value Chains. One significant concern is navigating regulatory frameworks that vary from one country to another. Compliance with local laws can be complex and may require substantial resources. This compels firms to invest in legal expertise to mitigate risks associated with non-compliance, which may lead to financial penalties or operational restrictions. Additionally, political instability in host countries can deter investment or disrupt existing operations. Companies must continuously assess geopolitical risks and devise strategies to adapt accordingly. Another challenge is fostering collaboration among diverse stakeholders, including suppliers, partners, and local authorities. Ensuring alignment of goals and expectations is critical to building effective partnerships. Moreover, cultural differences may lead to misunderstandings and miscommunication, hampering efforts to build trust. Therefore, companies investing in foreign markets must prioritize relationship management, cultural sensitivity, and continuous engagement with local entities. Ensuring effective governance and risk management strategies also contributes to minimizing the uncertainties associated with integrating into GVCs.

Technological advancements have profoundly reshaped the landscape of Foreign Direct Investment and Global Value Chains. As digital transformation accelerates, companies find opportunities to streamline operations and enhance efficiency through advanced technologies. Innovations such as blockchain, artificial intelligence, and big data analytics enable organizations to better manage supply chains, enhance transparency, and optimize resource allocation. Furthermore, technology facilitates communication and collaboration across geographically dispersed teams, allowing businesses to operate on a global scale efficiently. Companies engaging in FDI are increasingly adopting digital tools to improve real-time decision-making and responsiveness, thus enhancing competitiveness in international markets. Additionally, firms utilize data analytics to gain insights into consumer behavior and trends, enabling them to tailor products to meet local demands effectively. However, not every country possesses the necessary technological infrastructure to support advanced manufacturing processes or digital innovation. As a result, countries seeking to enhance their appeal to foreign investors must prioritize investments in technology education, infrastructure development, and research initiatives. Ultimately, embracing technology shapes the future of FDI and its potential to contribute to sustainable, integrated Global Value Chains.

The Impact of Global Value Chains on Local Economies

The integration of local economies into Global Value Chains through FDI has profound implications for socio-economic development. As foreign companies establish operations, they often introduce modern production techniques and processes that can significantly enhance local capabilities. This modernization effect leads to increased efficiency and productivity among domestic firms, enabling them to compete on a global scale. Moreover, the presence of multi-national companies creates a ripple effect on local businesses, prompting them to innovate and improve their offerings. The demand for goods and services from local suppliers rises, creating additional job opportunities and income generation. However, it is important to note that the integration into GVCs can also result in challenges. For instance, local businesses may find it difficult to compete against large multi-nationals in terms of resources and market reach. Therefore, fostering policies that support small and medium-sized enterprises (SMEs) becomes crucial. Governments must ensure that the benefits of FDI reach all segments of the population, mitigating potential inequalities that may arise from a disproportionate focus on large foreign investors.

The future of Foreign Direct Investment and its relationship with Global Value Chains is poised to evolve as international trade dynamics shift. Factors such as changing consumer preferences, environmental sustainability concerns, and the impacts of geopolitical tensions are increasingly shaping investment decisions. Companies are becoming more adaptive and responsive to these changes, emphasizing sustainability in sourcing and production processes. Investors are actively seeking ways to align their strategies with global sustainability goals, including reduced carbon footprints and ethical labor practices. Furthermore, the disruption caused by events such as the COVID-19 pandemic illustrates the vulnerabilities of complex supply chains. Companies are now reconsidering their reliance on singular sources and exploring opportunities to diversify their supply chains, which may lead to localized production efforts. Investing in areas closer to end consumers can mitigate risks associated with long-distance logistics and supply chain disruptions. This shift towards more resilient supply chains signifies a broader transformation driven by social and environmental factors. In conclusion, the future landscape of FDI and GVCs will reflect a more holistic approach, prioritizing sustainability alongside economic growth.

Conclusion

In summary, Foreign Direct Investment is pivotal for facilitating integration into Global Value Chains, serving as a crucial driver of economic development and competitive advantage. By attracting foreign capital, countries can unlock various benefits, from technology transfer to increased employment opportunities. However, navigating the associated challenges is essential to ensure sustainable growth and broad-based gains. As both investors and host countries adapt to evolving market demands and technological advancements, embracing innovation and fostering collaboration remains critical. The future of FDI will continue to reflect global shifts towards sustainability and resilience, emphasizing the importance of building strong relationships and managing risks effectively. Governments play an essential role in creating conducive environments that attract FDI while supporting local businesses and addressing potential inequalities. Ultimately, FDI and GVC integration must be approached as mutually beneficial endeavors that yield economic growth and promote social responsibility. In this interconnected world, fostering inclusive growth and sustainable practices will underpin the success of both global and local economies, shaping a prosperous future for all stakeholders in the international business landscape.